Your credit score is one of the initial things that lenders review when you place an application for a credit card or loan. Holding a strong credit score is viewed as the key to getting your loan application approved fast. Your credit score is computed post assessing various parameters. There are various parameters explained below. However, before going through those parameters, understand what a credit score is, which will help you understand the importance of credit reports provided by all 4 credit bureaus may it be CIBIL credit report, Equifax credit report or credit report from any other credit bureau. Also, it will allow you to understand the minimum CIBIL score for credit card or loans that you must have.

What’s a credit score?

A credit score is a 3-digit number which shows the lender or bank how likely you are to repay the money that you borrowed. Depending upon this, they basically determine whether they should give you the credit card or loan, and in case they decide in your favour, then at what credit card limit and interest rate, respectively. In simpler words, they use the credit score to decide whether you are worthy of the credit. Hence, in terms of financial terms, a credit score indicates your credibility as a customer.

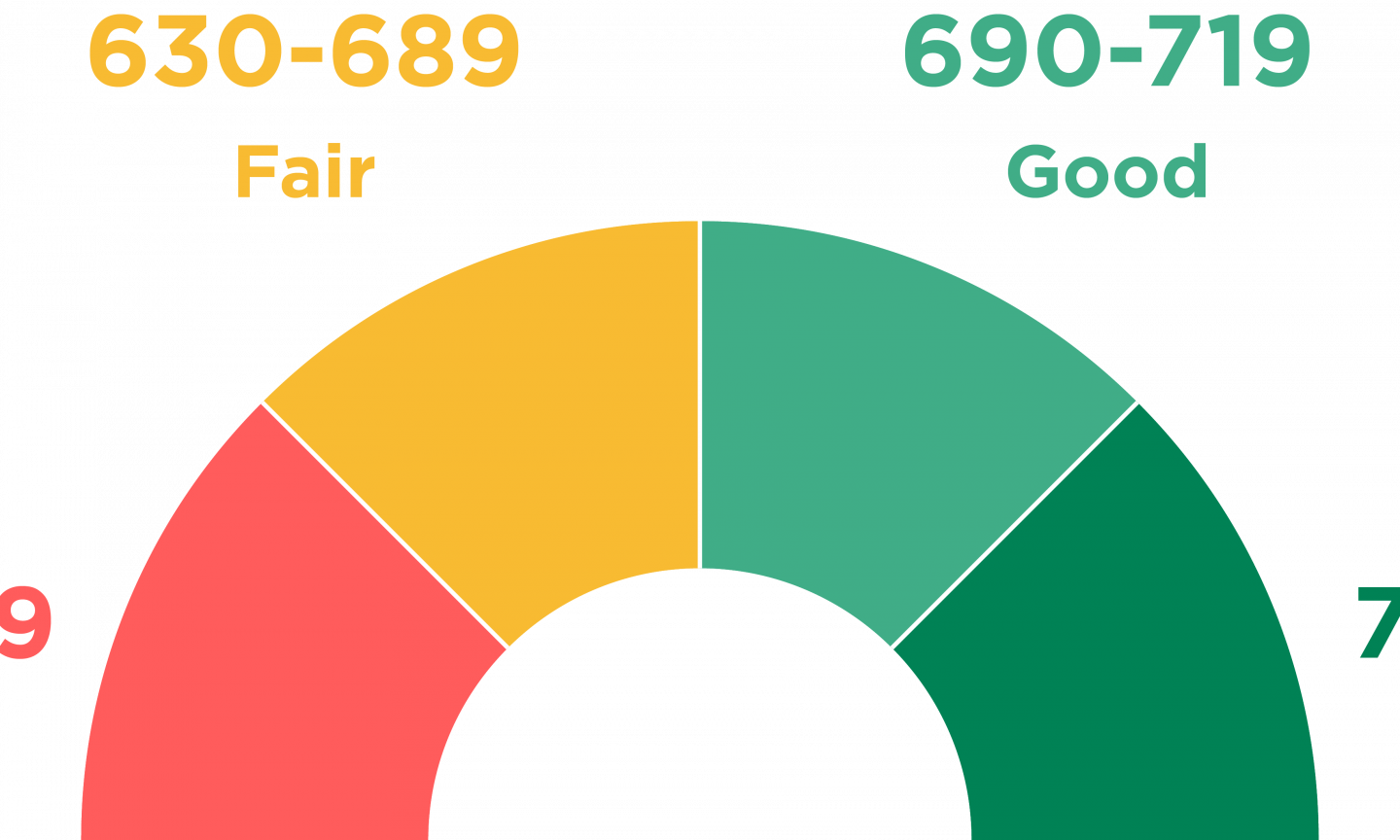

Now that you know what a credit score is understand credit score range between 300 and 900, wherein 750 is looked upon as a good credit score. A credit score below 750 is looked upon as poor, and creditors and lenders may disapprove your credit request on this ground. Thus, it is necessary to have a strong credit score. Holding a strong credit score of 750 and above enhances your chance of availing of credit approval as per your terms and conditions.

Where can you check your credit score?

There are 4 credit bureaus that compute your credit score. These credit bureaus include – CIBIL, Equifax, CRIF High Mark and Experian. Every credit bureau in India uses its own set of algorithms and formulas to compute your credit score. Hence, every bureau’s score varies from each other.

You can avail of the credit score by directly connecting with the respective credit bureaus. However, an easier and quicker way to do so is by fetching the online lending markets to avail of the credit report.

What should you do if you do not have a credit score?

You must begin by forming a score instantly as it enhances your chances of availing of a credit card or loan in the upcoming times. The quickest and simplest way to begin forming your credit score from zero is by applying for a credit card and using it for all your possible transactions. Ensure to use the credit card as per your repayment capacity and make sure to pay its bills on time by the due date. In case you are unable to avail of a regular credit card owing to any the reasons like – low income, unserviceable location, no credit score etc., you can apply for secured credit cards. Note that secured credit cards are available against your fixed deposits and function exactly the way as a regular credit card. Once you form your credit score using the secured credit card, you can apply for a regular credit card.

What are the crucial parameters impacting your credit score?

There are 5 parameters that impact your credit score. These include –

Your payment history

The most crucial parameter while computing your credit score is your payment history. Any missed payment, may it be – small or big, affects your score in a negative way. Not just does your credit score drop, but the lenders even take it as an indication of possible default chances in the future. Thus, ensure to maintain a strong credit score. This can be done if you timely make your credit card or loan repayments.

Your credit utilization ratio

The credit utilization ratio stands for your overall credit limit amount, which you spent in a specific month, divided by the overall credit card limit you have on your credit cards. For instance, if you hold an overall credit card limit of Rs 1 lakh and used Rs 40,000 of your overall credit card limit, then your credit utilization would be 40 per cent. In case you overuse your credit card limit, then issuers or lenders may address you as someone who spends more than what he/she can repay. Hence, never use your whole credit card limit.

Your credit history length

When computing your credit score, the credit bureaus do not factor in your age, but they consider how many years or the time had passed since you first took credit and when you availed your newest credit. Also, they factor in your average credit age (loan plus credit cards combined). The older your credit account age, the better it is for you to avail of more credit in the future.

Credit mix

Credit mix refers to the different kinds of credit accounts that show up on your report. There are 2 kinds of credit accounts – credit cards and loan accounts. A mix of both accounts is generally recommended. However, in the case of any imbalance in such a mix, lenders may not consider you as an eligible customer for a loan or credit card.

New credit

The more the number of your new credits in the current months, the lower your chances of availing your credit approval. To decide your eligibility for credit, lenders generally rely upon your old credits and not the new credits. Your old credits of over 2-3 years old allow them to understand your repayment behaviour and your behaviour with credit. In case your behaviour with credit has been good in the past, you hold a higher of securing approval on your current credit option.

Also, always ensure not to submit multiple credit enquiries in a short time span. This is also viewed as negatively by the credit bureaus, and they may lower your credit score, which indirectly lowers your chances of availing an approval on your new credit.

visit for more articles :https://forstory.org/